How to Use the Solana Chart to Predict Future Price Trends

Introduction to Price Prediction Using the Solana Chart

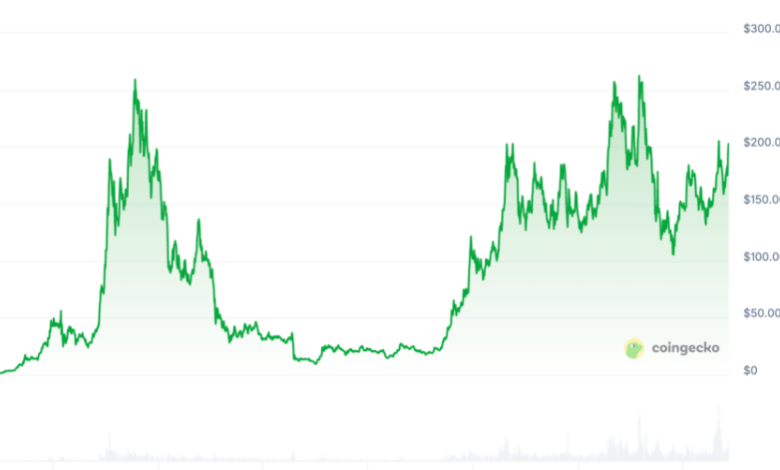

Predicting price trends in cryptocurrency is never exact, but the solana chart provides valuable clues about future price direction. By studying historical price behavior, trends, and indicators, traders and investors can identify high-probability scenarios rather than relying on guesswork.

In this guide, you’ll learn how professionals use the Solana chart to anticipate potential price movements and make informed decisions.

Why the Solana Chart Is Essential for Trend Analysis

The Solana chart visually displays market psychology. Every price movement reflects buying and selling decisions made by thousands of traders.

Key Benefits of Trend Analysis

- Helps identify long-term direction

- Improves trade timing

- Reduces emotional decision-making

- Enhances risk management

Understanding trend direction is often more important than predicting exact price levels.

Identifying Trends on the Solana Chart

Trends are the foundation of technical analysis.

Uptrend

- Series of higher highs and higher lows

- Indicates strong buying pressure

Downtrend

- Series of lower highs and lower lows

- Shows persistent selling pressure

Sideways Market

- Price moves within a range

- Signals indecision or consolidation

Trading in the direction of the dominant trend increases success rates.

Using Support and Resistance to Forecast Price Movement

Support and resistance are key levels on the Solana chart where price tends to react.

Support Levels

- Areas where buying pressure prevents further decline

- Often act as price floors

Resistance Levels

- Zones where selling pressure limits upward movement

- Act as price ceilings

When price breaks these levels, it often leads to strong momentum in the breakout direction.

Applying Technical Indicators to the Solana Chart

Indicators help confirm potential trends.

Moving Averages

- Identify overall trend direction

- Crossovers often signal trend changes

RSI (Relative Strength Index)

- Measures momentum

- Values above 70 indicate overbought conditions

MACD

- Shows momentum shifts

- Helps confirm trend strength

These tools work best when combined rather than used alone.

Volume Analysis on the Solana Chart

Volume confirms price movement.

- Rising price + increasing volume = strong trend

- Rising price + declining volume = weak trend

- Breakouts with high volume are more reliable

Volume is often overlooked, but it plays a critical role in price prediction.

Using Chart Patterns to Anticipate Future Moves

Chart patterns reveal potential continuation or reversal.

Common Predictive Patterns

- Ascending triangles

- Double bottoms

- Head and shoulders

Patterns increase predictive accuracy when supported by volume and indicators.

Multiple Timeframe Analysis

Analyzing more than one timeframe improves clarity.

How It Works

- Use higher timeframe for trend direction

- Lower timeframe for entry timing

This approach reduces false signals and improves consistency.

Risk Management When Predicting Trends

Even the best analysis can fail.

Risk Management Essentials

- Use stop-loss orders

- Never risk more than a small percentage of capital

- Avoid overleveraging

Successful traders focus on risk control, not perfect predictions.

FAQs About Predicting Trends Using the Solana Chart

1. Can the Solana chart really predict prices?

It doesn’t predict exact prices, but it helps identify probable trends.

2. Which indicator works best for SOL trend analysis?

Moving averages combined with RSI provide strong confirmation.

3. Is trend prediction suitable for beginners?

Yes, especially when focusing on higher timeframes.

4. How accurate is technical analysis?

Accuracy improves with experience and proper confirmation tools.

5. Should news be considered along with chart analysis?

Yes. News can significantly impact price trends.

6. Where can I analyze the Solana chart live?

Platforms like TradingView offer real-time analysis tools.

Conclusion: Smart Trend Analysis Starts With the Solana Chart

The solana chart is a powerful resource for understanding market behavior and identifying potential future trends. By combining trend analysis, indicators, volume, and risk management, traders can make more informed decisions and reduce unnecessary risks.

Consistency, patience, and continuous learning are the keys to improving price trend prediction.